Investments in Securities markets are subject to market risks, read all the related documents carefully before investing. Insurance is not an Exchange-traded product and Eliios Fintec Pvt Ltd is just acting as a distributor. All disputes with respect to the distribution activity, would not have access to the Exchange Investor Redressal Forum or Arbitration mechanism.

Eliios Fintec Pvt Ltd is a registered Mutual fund distributor with AMFI Reg no. ARN – 126278,

*Brokerage will not exceed the SEBI prescribed limit.

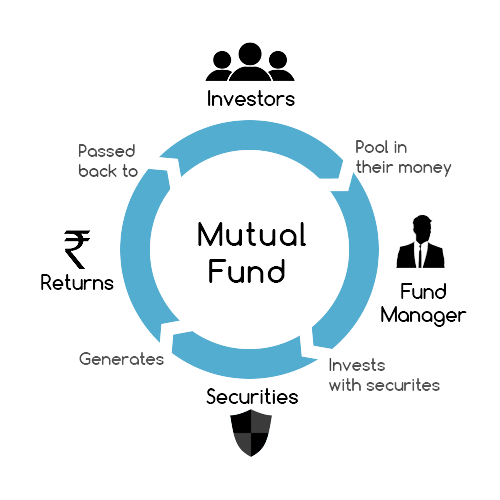

Mutual fund investments are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing a fund, or designing a portfolio that suits your needs.

Eliios Fintec Pvt Ltd (with ARN code 126278) makes no warranties or representations, express or implied, on products offered through the platform. It accepts no liability for any damages or losses, however, caused, in connection with the use of, or reliance on, its product or related services. Terms and conditions of the website are applicable. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries. The Android robot is reproduced or modified from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. Eliios Fintec Pvt Ltd is registered - | ARN - 126278 AMFI-Registered Mutual Fund Distributor |

Check your securities / mutual funds/bonds in the consolidated account statement issued by NSDL/CDSL every month.

Eliios Fintec Pvt Ltd CIN: U74999DL2021PTC390267 hasRegd. office:- Plot No. 40, G/F Shop Gali No 06, Mohan Nagar, New Delhi – 110 046.

Insurance is subject to market risks and is a subject matter of solicitation. It is the users’ responsibility to understand the restrictions and risks involved in different insurance products/policies. Under no circumstances can/will Wealth India Financial Services Limited take any liability for this. We request users to read and understand the offer and subject documents carefully.

.jpg)

.png)

.jpg)

.png)

.jpg)

.png)

.jpg)

.png)

.jpg)

.png)

.jpg)

.png)

.jpg)

.png)

.png)

.png)

.png)

.png)